Will Real Estate be Affected by the Government Shutdown?

Posted by Jeff Brooks on

The Government Shutdown may affect Real Estate over the coming weeks. Perhaps not market values, but existing transactions, and buyers looking to make offers. Being a Realtor, I’m certainly not furloughed and neither are most other private sector jobs. But in a community like Newport RI, it may end up affecting us more directly than we’d like.

Nearly 900,000 federal employees were told not to come into work on Tuesday. That’s nearly a third of all persons being paid directly by the US. These people include members of the DoD, National Parks, Memorial Administration, FHA and IRS. Since 1975 there have been 17 government shutdowns, averaging nearly a week. Ranging from 1 to 21 days each.

How it Affects Newport County:

Here in Newport…

2173 Views, 0 Comments

A great 2013 Buying Opportunity in Portsmouth, RI

A great 2013 Buying Opportunity in Portsmouth, RI

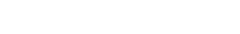

These charts make me think back to my Economics Classes at Saint Anselm College with Professor Romps, specifically about supply, demand and the “invisible hand”. Prof. Romps was a 6’3” 280lb angry 65 year old man. It was impossible to fall asleep in his class even at 9am on Friday. In…

These charts make me think back to my Economics Classes at Saint Anselm College with Professor Romps, specifically about supply, demand and the “invisible hand”. Prof. Romps was a 6’3” 280lb angry 65 year old man. It was impossible to fall asleep in his class even at 9am on Friday. In…

Median price vs. inventory, Newport, RI, 11/8/12

Median price vs. inventory, Newport, RI, 11/8/12

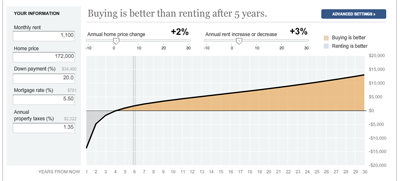

To Buy or To Rent? A tool to help you decide.

To Buy or To Rent? A tool to help you decide.

Punxsutawney Phil - Correct 40% of the Time

Punxsutawney Phil - Correct 40% of the Time