3 Lessons Learned from Warren Buffet's take on Real Estate Investing

Posted by Jeff Brooks on

Investing in Real Estate? Lets ask Warren Buffett, the infamous investor worth billions who is commonly known as “The Oracle of Omaha”. His insight in investing I’ve always found to be a very simple, easy and straight forward. This article delves into two real estate investments he’s made. Here’s a few points I walked away with;

-Ignore the outside noise and chatter

-Ignore the outside noise and chatter

When we were in the depths of the Great Recession Mr. Buffett was buying up companies left and right, while the rest of the market went running for the hills. His Berkshire Hathaway holding company bought Prudential Real Estate as his method of jumping into the real estate market. But years ago, he made a few real estate plays himself, ignoring the noise around him, he focused on the…

2136 Views, 0 Comments

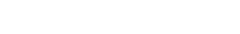

To Buy or To Rent? A tool to help you decide.

To Buy or To Rent? A tool to help you decide.

Punxsutawney Phil - Correct 40% of the Time

Punxsutawney Phil - Correct 40% of the Time